iedge s reit

BYI Phillip SGX APAC Dividend. You have unlocked this subscriber-only story.

S Reit Report Card Here S How Singapore Reits Performed In Fourth Quarter 2019

Please verify your email to read subscriber-only stories.

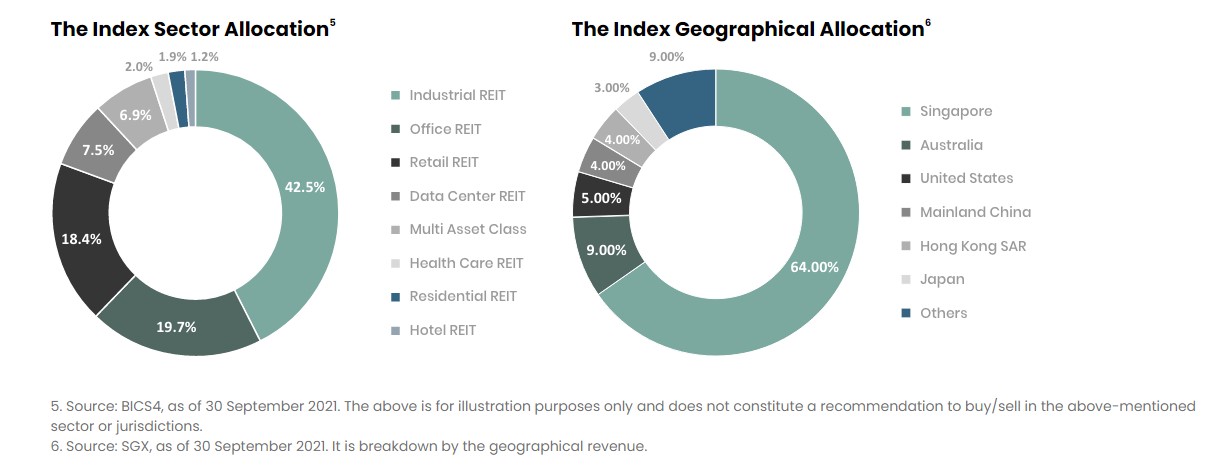

. You have reached your. Retail industrial data centre office hospitality and healthcare. Proxied by iEdge S-REIT Leaders SGD Index Total Return 4.

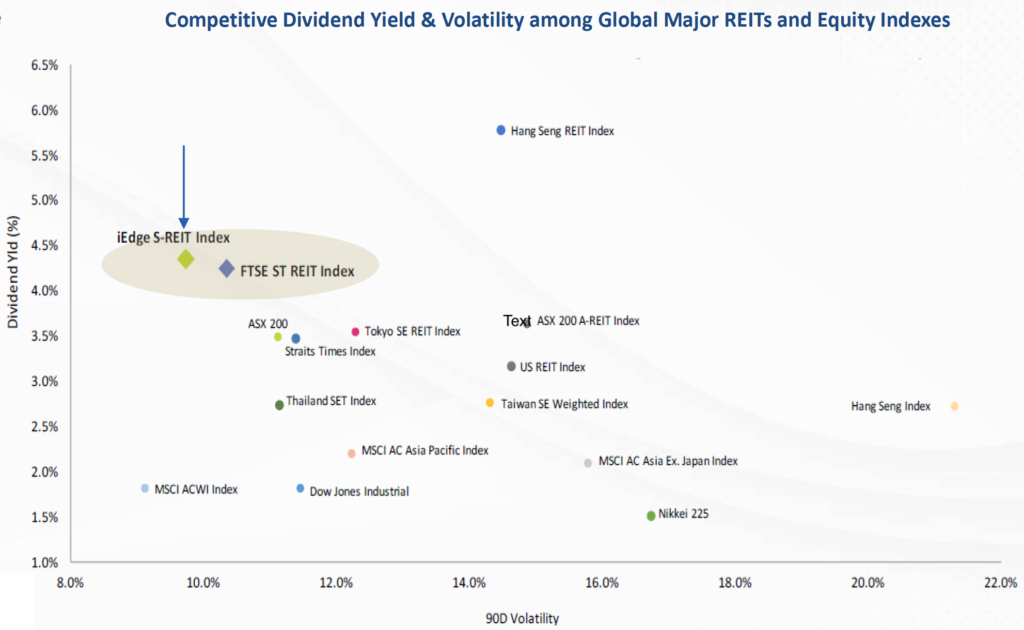

CSOP iEdge S-REIT Leaders Index ETF SRTSRU The performance of the iEdge S-REIT Leaders Index which mostly comprises of S-REITs. Proxied by iEdge S-REIT Leaders SGD Index Total Return 4 Source. It has delivered an annualised return of 992 in the past 5 years and a dividend yield last 12 months of 396.

The CSOP iEdge S-REIT Leaders Index ETF is available in two main currencies SGD and USD. Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance. If we assume dividends are not reinvested the returns would have been 431.

Based on historical data we can see that its total return of the iEdge S-REIT Leaders Index over the past 5 years is at 950 inclusive of dividends being reinvested. Refers to dividend yield of iEdge S-REIT Leaders Index. Already have an account.

UOB APAC Green REIT ETF GRNSI The performance of the iEdge-UOB APAC Yield Focus Green REIT Index. The iEdge S-REIT Leaders Index ETF is a diversified and return-focused ETF that provides investors with exposure to some of the most important uprising industriesin real estate in different geographical locations with Singaporebeing the. GIFT A STORY.

2 months 3 months 6 months 9 months 1. Phillip SGX APAC Dividend Leaders SGX. In FY202122 the REIT have completed an S8233m equity fund raising exercise comprising approximately S5129m from private placement and S3104m from preferential offering to partially finance the acquisition of 29 data centres which garnered robust support from a broad spectrum of investors.

It is a market capitalisation weighted index that tracks the performance of the most liquid REITs in Singapore. Syfe REIT has exposure across various property sectors in Singapore including. Bloomberg 14 October 2011 15 October 2021.

In 2021 the dividend yield is estimated to increase to 51. The latest 12-month dividend yield is at 408 as of 31 October 2021. As per their website CSOP iEdge S-REIT Leaders Index ETF currently has a management fee of 05 per year though that may increase to a maximum of 08.

The ETF aims to replicate the iEdge S-REIT Leaders Index as closely as possible. SGX as of 30 June 2021 6 Source. GIFT A STORY.

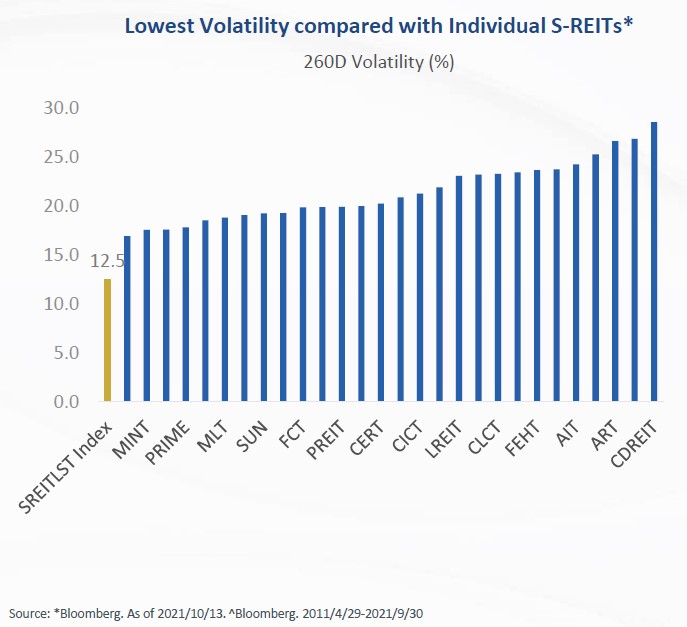

6 May 2016 to 31 March 2022. Thank you for registering. With the soon to be listed CSOP iEdge S-REIT Leaders Index ETF investors will now be able to invest in S-REITs via an ETF to reap its diversification benefits.

Launched in 2014 the iEdge S-REIT Leaders Index is an index established to measure the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange SGX. As of 15 Aug 2022 NAV - 09565 Expense Ratio - Nil. SGX as of 30 September 2021.

Singapore REITs A Reopening Story. The Index consists of 28 S-REITs one more than the Morningstar Singapore REIT Yield Focus Index which is tracked by the Lion-Phillip S-REIT ETF SGX. To ensure that the REITs tracked by the index are the most liquid REITs the iEdge S-REIT Leaders Index employs a liquidity-adjustment strategy.

Constituents must be listed on SGX and classified under Reits as defined by the Factset Revere Business Industry Classification System. Easy Tradability with Minimal Investment Threshold. You can change your settings at any time.

Based on historical data we can see that its total return of the iEdge S-REIT Leaders Index over the past 5 years is at 950 inclusive of dividends being reinvested. The CSOP iEdge S-REIT Leaders Index ETF has a management fee of 05 and a total expense ratio of 06 which is capped and would be deducted annually as fees. The iEdge S-Reit Leaders Index is a narrow tradable adjusted free-float market capitalisation weighted index that measures the performance of the most liquid trusts in Singapore.

GIFT A STORY. Bloomberg CSOP 6 May. This index aims to measure the performance of the largest and most traded REITs on the SGX.

To learn more about how we collect and use cookies and how you configure. Constituents of the iEdge S-Reit Index SIGN UP FOR FREE. IEdge S-REIT Index - Singapore Exchange SGX We use cookies to ensure that we give you the best experience on our website.

If you click Accept Cookies or continue without changing your settings you consent to their use. It has returned an average of 87 per year over the last eight years and delivered 45 dividend yield in 2020. The ongoing charges total expense ratio of 06 takes management fee into account and includes other fees for administration and recordkeeping among others.

Bloomberg SGX as end of 2020 2 Source. SGX as of 30 September 2021 5 Source. The investment objective of CSOP iEdge S-REIT Leaders Index ETF the Sub-Fund is to replicate as closely as possible before fees and expenses the performance of the iEdge S-REIT Leaders Index the Index Alerian Energy Infrastructure ETF Declares Third Quarter 2022 Distribution Payable on.

The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014. If we assume dividends are not reinvested the returns would have been 431. SRT - CSOP iEdge S-REIT Leaders ETF Price Holdings Chart more for better stock Trade investing.

The latest 12-month dividend yield is at 408 as of 31 October 2021. Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet. Easy trading like a stock Low investment threshold low ongoing cost and low transaction cost Board lot is 1 only and minimal investment is SGD 1 only.

Online subscription for the ETF is now open during the Initial Offer Period IOP online from 29 October 2021 till 15 November 2021 by 930am.

Any Opinion Whether It S Worth Investing The New Ipo Csop Iedge S Reit Leaders Index Etf Seedly

南方东英iedge新加坡房地产投资信托领先指数etf将在新交所上市 Business Wire

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

What You Need To Know About Csop Iedge S Reit Leaders Index Etf The Singaporean Investor

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Reits Report Card 2021 How Singapore Reits Performed In 2nd Quarter 2021

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Csop Iedge S Reit Leaders Index Etf Poems

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Csop Iedge S Reits Leaders Index Etf Riding The Wave With S Reits Leaders Youtube

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Why Singapore Reit Investors Should Consider Investing Via The Iedge S Reit Leaders Index

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Comments

Post a Comment